Financial Calculators

| What is EMI ? |

|

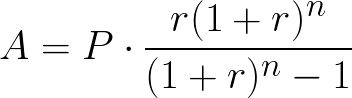

According to WikiPedia an Equated Monthly Installment (EMI) is defined as "A fixed payment amount made by a borrower to a lender at a specified date each calendar month. Equated monthly installments are used to pay off both interest and principal each month, so that over a specified number of years, the loan is paid off in full." It further explains that, with most common types of loans, such as real estate mortgages, the borrower makes fixed periodic payments to the lender over the course of several years with the goal of retiring the loan. EMIs differ from variable payment plans, in which the borrower is able to pay higher payment amounts at his or her discretion. In EMI plans, borrowers are usually only allowed one fixed payment amount each month. The benefit of an EMI for borrowers is that they know precisely how much money they will need to pay toward their loan each month, making the personal budgeting process easier. The formula for EMI (in arrears) is:

|

| What is Amortization Table ? |

|

An amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage),

as generated by an amortization calculator.

Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments.

A portion of each payment is for interest while the remaining amount is applied towards the principal balance.

The percentage of interest versus principal in each payment is determined in an amortization schedule.

Read more at WikiPedia. |

| What is Financial Year Amortization Table ? |

|

The financial year calculation presents the amortiztion table on a fiscal year basis.

Normally Annual Amortiztion Table will show the calculations for a 12 months period from the starting EMI.

e.g. You are in India where the financial year is from April 1st to March 31st. You have taken loan for 3 years (36 months). Your first EMI is in the month of June 2015. Your last EMI is in the month of May 2018.

In many countries these principal and interest components are used for tax calculations for a given fiscal year. This tool will help in identifying each years share of principal and interest in the repayments. |